Personal Injury Lawyers

Updated: Sep 18, 2020, 04:22 am

If you have been hurt as a result of someone’s carelessness, you probably feel a lot of different emotions – anger, frustration, worry, and anxiety are common. That is not abnormal, and it is certainly understandable. A Georgia personal injury lawyer at Sessions & Fleischman can. One of our goals is to provide you with information that will help you identify a personal injury lawyer that can get clarity and the compensation that you deserve from the person that caused your injury.

We’re focused on getting to the heart of your case. It’s really easy to get bogged down in the details of any given case and to get held up with procedural problems. When delays occur, evidentiary problems arise with the loss of evidence and an inability to locate witnesses. Our goal is is to make this process as simple as possible as we can for you and to help you understand what is going to happen with your case – it is your personal injury case. We want you to know what actionable steps we’re taking to make sure that we help you get the maximum recovery out of your case as quickly as possible. Those are our goals and everything that we do going forward should be with those goals in mind.

Whether you have been hurt in a car accident or suffered as a result of the negligence of a doctor, a qualified and experienced injury attorney can help you understand the legal process and your rights. Call Sessions & Fleischman, LLC, today for a free consultation.

Georgia Personal Injury Cases

In Georgia, to bring a personal injury claim, you must be able to show that you were injured as a result of someone else’s negligence or intentional conduct. This means that you must be able to prove that the other party failed to act with the level of care that a reasonable person would have exercised in the same or similar circumstances, and that their failure to act caused your injuries.

To bring a successful personal injury claim in Georgia, you will generally need to establish the following elements:

- Duty of care: You must be able to show that the other party owed you a duty of care, which is a legal obligation to act in a way that does not cause harm to others.

- Breach of the duty: You must be able to show that the other party breached this duty of care by failing to act with the level of care that a reasonable person would have exercised in the same or similar circumstances.

- Causation: You must be able to show that the other party’s breach of duty was the cause of your injuries.

- Damages: You must be able to show that you suffered damages as a result of the other party’s actions, such as medical bills, lost wages, or property damage.

It is important to note that personal injury claims can be complex and may involve a variety of legal issues. It is best to consult with an experienced personal injury attorney to help determine the viability of your claim and to advise you on the best course of action.

What is the process you should expect in your personal injury case?

The process that your personal injury case will follow can be divided into several parts: (1) pre-lawsuit process, (2) lawsuit/court process, (3) your attorney’s actions, and (4) your/the client’s actions.

The pre-lawsuit process generally involves actions by both the lawyer and the client. In the pre-lawsuit phase of a personal injury case, the client is performing a few very important tasks:

- Getting the highest quality medical care and treatment possible,

- Communicating with their attorney about the incident and treatment, and

- Keeping their attorney updated about the status of treatment.

In the pre-lawsuit phase of your personal injury case, your lawyer will investigate and preserve evidence related to your accident case. We believe that it is important that accident victims not have to take on the stress and anxiety of worry about how or why an injury occurred. That is a task that we take very seriously and we invest significant amounts of money in many cases to properly develop and document the facts of the case completely separate from your injuries.

Seeking medical treatment as soon after an injury as possible is extremely important. If there is a lapse in time between your injury and seeking medical care, it is inevitable that insurance carriers will use that gap in time against you.

Personal Injury Case Evaluation

One of the most critical aspects of exceptional representation in personal injury cases is an ongoing evaluation of your claim, damages, insurance, and liability. This includes gathering evidence, reviewing medical records, and assessing the impact of the injury on your life. It is not uncommon for people to get finished with prolonged treatment only to find out that their lawyer no longer wishes to represent them or doesn’t believe in the case as strongly as the stated at the outset of the case.

One of our primary goals is to keep open and honest dialogue occurring with our clients. We want you to know where the case is going and what we believe should occur with your case.

4. Demand Letter:

- In many cases, we start by sending a demand letter to the at-fault party or their insurance company. This letter outlines the details of the accident, the extent of your injuries, and the compensation you are seeking. It initiates the negotiation process.

We engage in negotiations with the insurance company or the responsible party to obtain the maximum compensation possible for you. Our goal is to secure compensation for medical expenses, lost wages, property damage, and pain and suffering without the need for litigation.

If we cannot resolve a case through negotiations, a lawsuit must be filed within the statute of limitations. With the filing of a lawsuit, our accident attorneys will file a complaint in the appropriate court and have the complaint served upon the at-fault party with a summons.

7. Discovery:

- Both parties exchange information and evidence relevant to the case during the discovery phase. This may include depositions, interrogatories, and document requests. Discovery helps each side understand the strengths and weaknesses of their case.

8. Mediation:

- Prior to trial, many personal injury cases go through mediation. A neutral third party facilitates discussions between the parties to find a mutually agreeable resolution. Mediation can be an effective alternative to a court trial.

9. Trial:

- If a settlement is not reached through negotiation or mediation, the case proceeds to trial. Our experienced trial attorneys will present your case in court, advocating for your rights and seeking the compensation you deserve.

Value of your personal injury case

There are several factors that can influence the value of a personal injury case:

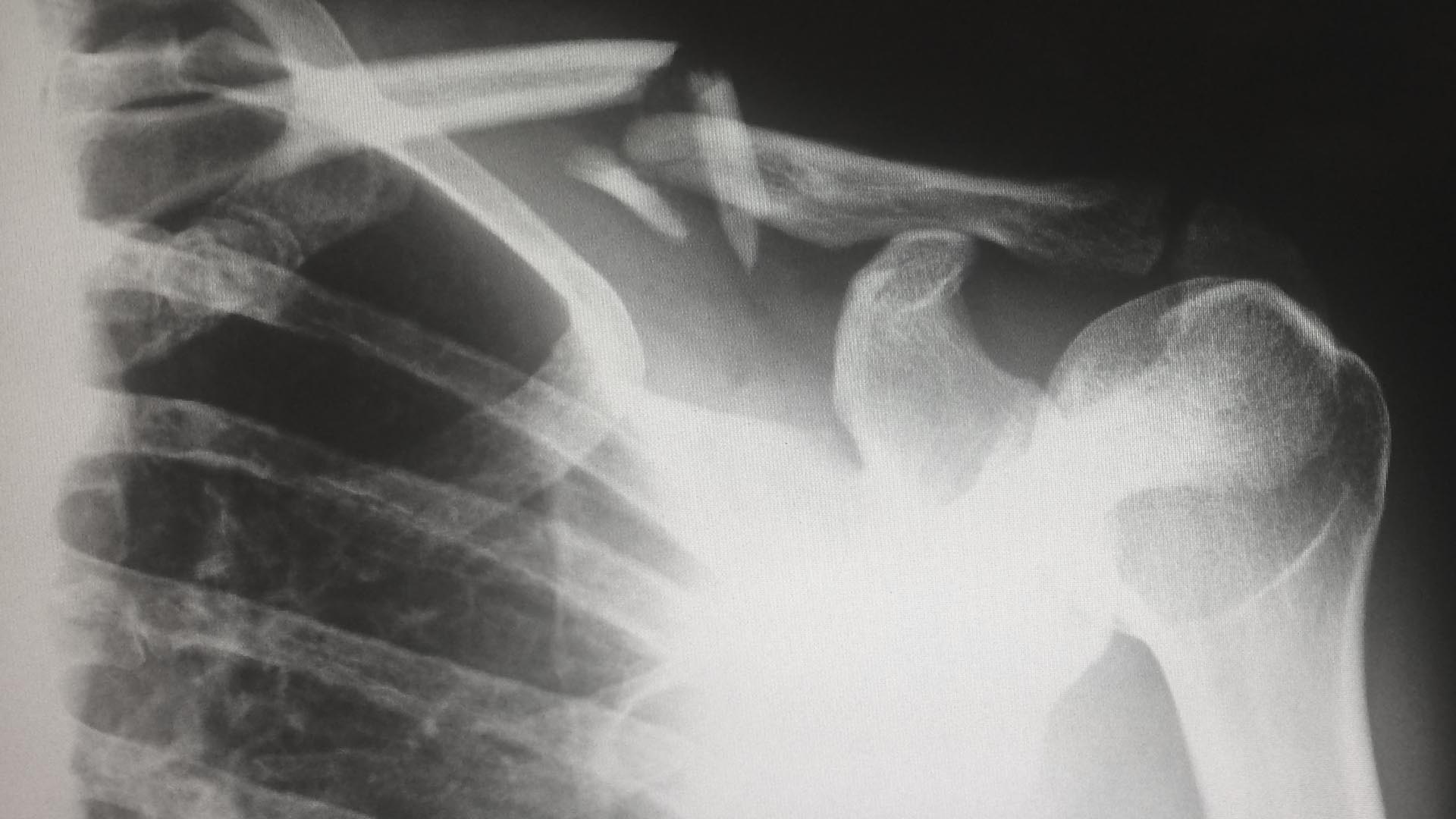

- The extent of the injuries: The more severe the injuries, the higher the potential value of the case.

- The cost of medical treatment: The cost of medical treatment for the injuries sustained can significantly impact the value of the case.

- Lost wages: If the injuries prevent the victim from working, the lost wages can be included in the damages sought.

- Pain and suffering: Non-economic damages, such as pain and suffering, can also be included in the damages sought in a personal injury case.

- Comparative negligence: If the victim is partially at fault for the accident, the damages may be reduced by the percentage of fault assigned to the victim.

- Insurance coverage: The insurance coverage of the at-fault party can also influence the value of the case.

It’s important to note that every personal injury case is unique and the value of a case will depend on the specific circumstances and facts involved. An experienced personal injury attorney can help you understand the potential value of your case and advise you on the best course of action to take to seek damages.

You’ll frequently hear people discussing the valuation of personal injury cases talking about value enhancers. Value enhancers are facts in the case that increase what the case is perceived to be worth. Things that increase the value of your personal injury case can take many different forms. Value enhancers may be an extreme or graphic injury caused by the party. It could be exceptional cases of recklessness or negligence by the defendant. For example, a DUI driver in a car accident is a real value driver in most cases. It could also be a repeated pattern of failure to properly maintain a truck, for example. All those things are facts that we can look at as potential value drivers in personal injury cases, and they are by no means an exclusive list of value enhancers or value drivers. We certainly want to look for those things and, particularly, actions on behalf of the defendant or things that the defendant failed to do that could be real value drivers or enhancers.

For many of our clients, their injury severely and even catastrophically impacted the financial wellbeing of their family. The financial strain of an injury can be overwhelming, so it is not surprising that many clients are concerned with how much their personal injury case is worth.

Be careful of only valuing your personal injury case based upon a multiple of your medical expenses. It is very common for lawyers to take the total of your medical expenses and to recommend that clients settle cases for 1.5 to 3 times that amount without giving consideration to other important value drivers in a case.

The most common types of personal injury cases

Anytime that there is an injury that is caused by someone else’s negligence or recklessness and there are injuries resulting from that carelessness, there is a potential personal injury case. These are the most common types of personal injury cases:

- Slip and fall accidents

- Car accidents

- Motorcycle accidents

- Truck accidents

- Medical malpractice

- Workplace injuries

- Dog bites

- Defective products

- Premises liability

- Nursing home abuse and neglect

- Assault and battery

- Wrongful death

It’s important to note that the specific types of personal injury cases may vary depending on the jurisdiction and the specific circumstances of the case. These are just some of the most common types of personal injury cases that people may encounter. If you have been injured and are considering seeking legal action, it is important to speak with a qualified personal injury attorney to discuss your options and determine the best course of action.

Choosing a personal injury lawyer

Despite all of our technological advances, in our view, the best way to choose a personal injury lawyer remains speaking with them directly.

These are some of the considerations that we encourage people to evaluate in choosing personal injury lawyers. Obviously, some of these factors are more important than others:

Choosing the right lawyer for your personal injury case is crucial to ensuring that you receive proper representation and maximize your chances of a favorable outcome. Here are some steps you can take to select the right lawyer for your situation:

- Specialization in Personal Injury Law:

- Look for a lawyer who specializes in personal injury law. This ensures that they have the specific knowledge and experience in helping clients with catastrophic injuries. It is also important that your attorney has experience with your type of personal injury case. For example, a brain injury and the science involved in that type of case is significantly more complex than your typical broken bone case.

- Experience:

- Consider the lawyer’s experience in handling personal injury cases. An attorney with a proven track record in similar cases is more likely to understand the complexities and nuances of your situation. Does the lawyer have years of experience handling personal injury cases?

- Reputation:

- Research the lawyer’s reputation. Look for reviews and testimonials from past clients. You can check online review platforms, legal directories, and bar association websites for information about the lawyer’s reputation.

- Credentials:

- Verify the lawyer’s credentials, including their education, licensing, and any certifications related to personal injury law.

- Initial Consultation:

- Many personal injury lawyers offer free initial consultations. Take advantage of this to meet with potential attorneys and discuss your case. Use this time to assess their knowledge, communication skills, and whether you feel comfortable working with them.

- Fee Structure:

- Understand the lawyer’s fee structure. Many personal injury lawyers work on a contingency fee basis, meaning they only get paid if you win your case. Be clear about the percentage they will take and any additional costs.

- Resources and Support Staff:

- Inquire about the lawyer’s resources and support staff. A well-equipped law firm with experienced paralegals and support staff can handle your case more efficiently.

- Communication Style: Effective communication is essential. Choose a lawyer who keeps you informed about the progress of your case and promptly responds to your questions or concerns.

- Local Knowledge: It can be beneficial to choose a lawyer with knowledge of the local legal system and a good reputation within the local community.

- Conflict of Interest: Ensure there is no conflict of interest that could affect the lawyer’s ability to represent you impartially.

- Trust Your Instincts: Ultimately, trust your instincts. If you don’t feel comfortable with a particular lawyer or have doubts about their ability to handle your case, consider looking for someone else.

Import Personal Injury Terms

- Personal Injury: Harm caused to an individual’s body, mind, or emotions.

- Negligence: Failure to exercise reasonable care, resulting in harm to another.

- Liability: Legal responsibility for one’s actions or inactions.

- Damages: Monetary compensation sought by a plaintiff for losses suffered.

- Compensatory Damages: Damages to compensate for actual losses.

- Punitive Damages: Damages to punish and deter particularly egregious conduct.

- Statute of Limitations: The time limit within which a lawsuit must be filed.

- Comparative Negligence: Reducing damages based on the plaintiff’s own negligence.

- Contingency Fee: Lawyer’s fee paid from the settlement/judgment if the case is won.

- Settlement: An agreement to resolve a case without going to trial.

- Plaintiff: The person bringing a lawsuit.

- Defendant: The person/entity being sued.

- Insurance Claim: A request for payment under the terms of an insurance policy.

- Pain and Suffering: Non-economic damages for physical and emotional distress.

- Medical Malpractice: Professional negligence by a healthcare provider causing harm.

- Wrongful Death: A claim arising when someone dies due to another’s negligence or intentional act.

- Workers’ Compensation: Insurance providing wage replacement and medical benefits for work-related injuries.

- Premises Liability: Responsibility of property owners to ensure safety for visitors.

- Product Liability: Responsibility of manufacturers/sellers for injuries caused by defective products.

- Trial Experience: A lawyer’s experience in representing clients in court.

- Tort: A wrongful act leading to civil legal liability.

- Duty of Care: The obligation to avoid acts or omissions that could harm others.

- Breach of Duty: Failure to meet the standard of care.

- Causation: The link between the breach of duty and the injury.

- Economic Damages: Compensation for financial losses (e.g., medical bills, lost wages).

- Non-Economic Damages: Compensation for non-financial losses (e.g., pain and suffering).

- Special Damages: Specific monetary losses incurred by the plaintiff.

- General Damages: Non-monetary damages such as pain and suffering.

- Loss of Consortium: Damages awarded to family members for loss of companionship.

- Subrogation: The right of an insurer to pursue a third party that caused an insurance loss to the insured.

- Joint and Several Liability: When multiple parties are liable, each may be responsible for the full amount of damages.

- Gross Negligence: Extreme carelessness showing a reckless disregard for the safety of others.

- Assumption of Risk: A defense where the plaintiff knowingly and voluntarily engages in a risky activity.

- Strict Liability: Liability without the need to prove negligence or fault.

- Vicarious Liability: Legal responsibility of one party for the actions of another.

- Expert Witness: A specialist who provides testimony in their area of expertise.

- Depositions: Sworn, out-of-court testimony used to gather information before a trial.

- Interrogatories: Written questions exchanged between parties to gather information before a trial.

- Discovery: The pre-trial process of exchanging evidence and information.

- Litigation: The process of taking legal action.

- Mediation: A method of resolving disputes outside of court with the help of a neutral third party.

- Arbitration: A method of resolving disputes outside of court where an arbitrator makes a binding decision.

- Filing a Claim: The process of formally initiating a lawsuit.

- Demand Letter: A letter requesting payment or action to settle a dispute.

- Summons and Complaint: Documents that initiate a lawsuit and notify the defendant.

- Answer: The defendant’s formal response to the complaint.

- Motion: A formal request made to the court for a specific action.

- Preponderance of the Evidence: The standard of proof in civil cases, meaning “more likely than not.”

- Appeal: A request for a higher court to review a lower court’s decision.

- Judgment: The final decision made by a court in a lawsuit.

Georgia Personal Injury Attorneys

At Sessions & Fleischman, we have a proven track record of success in handling personal injury cases. Our attorneys have extensive experience and a deep understanding of the legal process, and are dedicated to advocating for the rights of our clients. We are committed to providing personalized, responsive service and will work tirelessly to help you get the compensation you deserve. If you have been injured due to the negligence or wrongdoing of another party, we encourage you to contact us to schedule a consultation and discuss your case.

Frequently Asked Questions (FAQs)

Does Medicare have to be repaid from my personal injury settlement?

What are the first steps that we’ll take in your personal injury case?

Should I follow the referral from a medical care provider to a certain lawyer?

Why is an uninsured motorist policy so important to protect you in the event of car accident?

Should I move my vehicle after a car accident or wait until the police arrive?

More from

Personal Injury Attorney in Macon, GA

Savannah Personal Injury Lawyer

Milledgeville Personal Injury Attorney

Ben Sessions has personally tried over 60 cases to a jury, and he has successfully litigated cases before both the Georgia Supreme Court and the Georgia Court of Appeals. We understand that aggressively preparing cases for a jury trial is frequently the best way to a resolve a case. When you meet with us, we’ll help you understand the process and we’ll also relieve a lot of the stress that you may have about the process involved with your case. If you want a lawyer that is willing to fight to the very end for your cause, Ben Sessions is the lawyer for you. Ben has built his reputation among former clients and other lawyers by being willing to stand up for people in the hardest times in their lives. If the obstacles in your case seem too large, if the other side appears too rich, if the other side appears to have too much power, Ben Sessions is the lawyer you need to call.